Key findings from State of Web3 Report

Quick note: I’ve renamed this newsletter from “Chasing Yield” to “Gasless”. I’ll detail the reasons for the change in the future post but this is all part of positive changes for the future. All previous links will still work.

I combed through the recent State of Web3 Report by Chainalysis so you wouldn’t have to.

You can download the full report here.

These are key findings jumping out of the report:

DeFi is for “boomers”

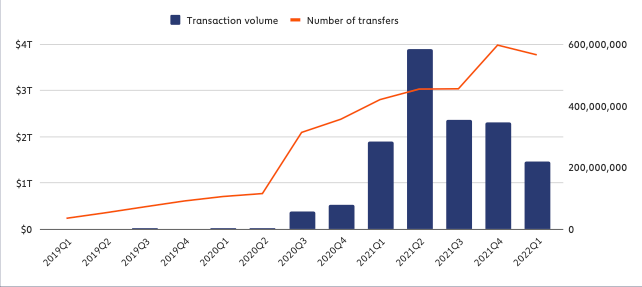

DeFi made up most of the excitement in the early days of the bull market but the transactions and volume has mostly tapered down with the onset of the bear market.

This is not to say that DeFi is going anywhere. In fact it’s here to stay but the use case is more for people who already own crypto.

“…and our data shows that DeFi adopters tend to be already established cryptocurrency users.”

NFTs & gaming are the gateway drugs

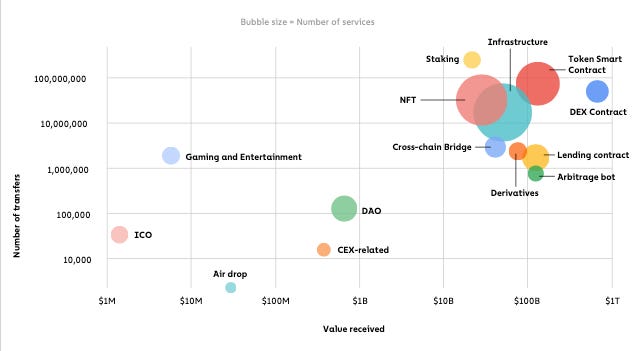

The next billion crypto users will come through NFTs & gaming. The volume and transaction numbers are close to that of DeFi even though they emerged later in the bull cycle.

“…our data suggests that the rise of NFTs has attracted many users who hadn’t previously engaged with the cryptocurrency ecosystem.”

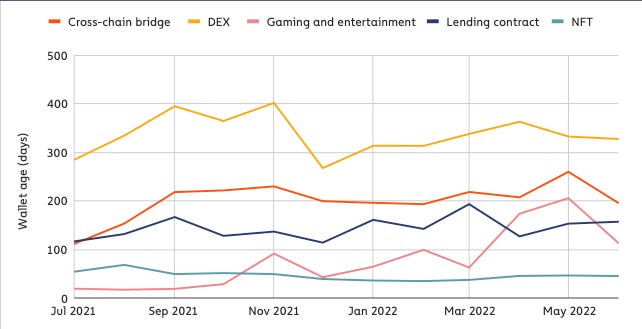

Wallets carrying out their first NFT transaction are generally younger than wallets transacting through other types of DeFi protocols, suggesting that NFT users are more likely to be newer to crypto.

Fees matter for retail

We didn’t have a clear ETH killer this cycle but we could see it emerge in the next one if ETH doesn’t solve its high and unpredictable fee issues.

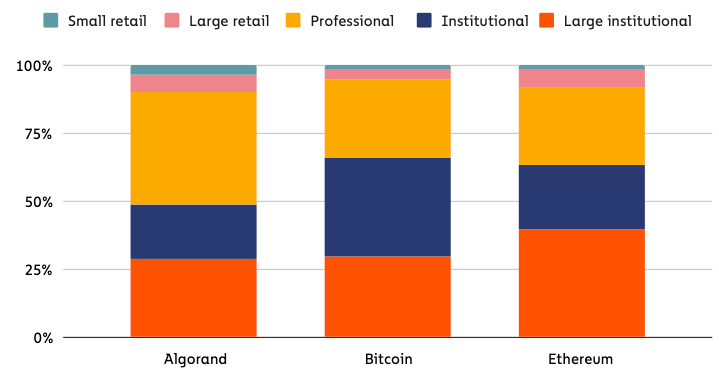

Even if we peered into one of the less well known alt L1s like Algorand, we find that 10% of its transaction volume comes from retail or large retail transactions, compared to 5% for BTC and 8% for ETH.

Chains with lower transaction fees are clearly able to attract higher amounts of volume in terms of smaller transactions from retail participation.

It’s not inconceivable to extrapolate that if one or a few of these alt L1s are able to execute well on NFTs and gaming while maintaining low fees, the next billion users will be onboarded there as opposed to ETH.

Hint:

One area where SOL is growing rapidly is NFTs. It has surpassed ETH in individual 24-hour periods. Nearly 15 million NFTs have been minted through Metaplex, the NFT standard on SOL, versus just over 1 million on ETH.

DEXs over CEXs

DEXs saw more transaction volume than their centralized counterparts during this recent cycle. However this could be due a short term trend due to yield farming on DEXs.

What I find interesting is the user behavioral difference and its future implications:

Just 7% of DEX users’ funds came from a CEX, but 16% of CEX users’ funds came from another CEX. This could reflect DEX users’ preference for self-custody — both personally and when deciding with whom to transact — over third-party custody.

DAOs are still DINOs

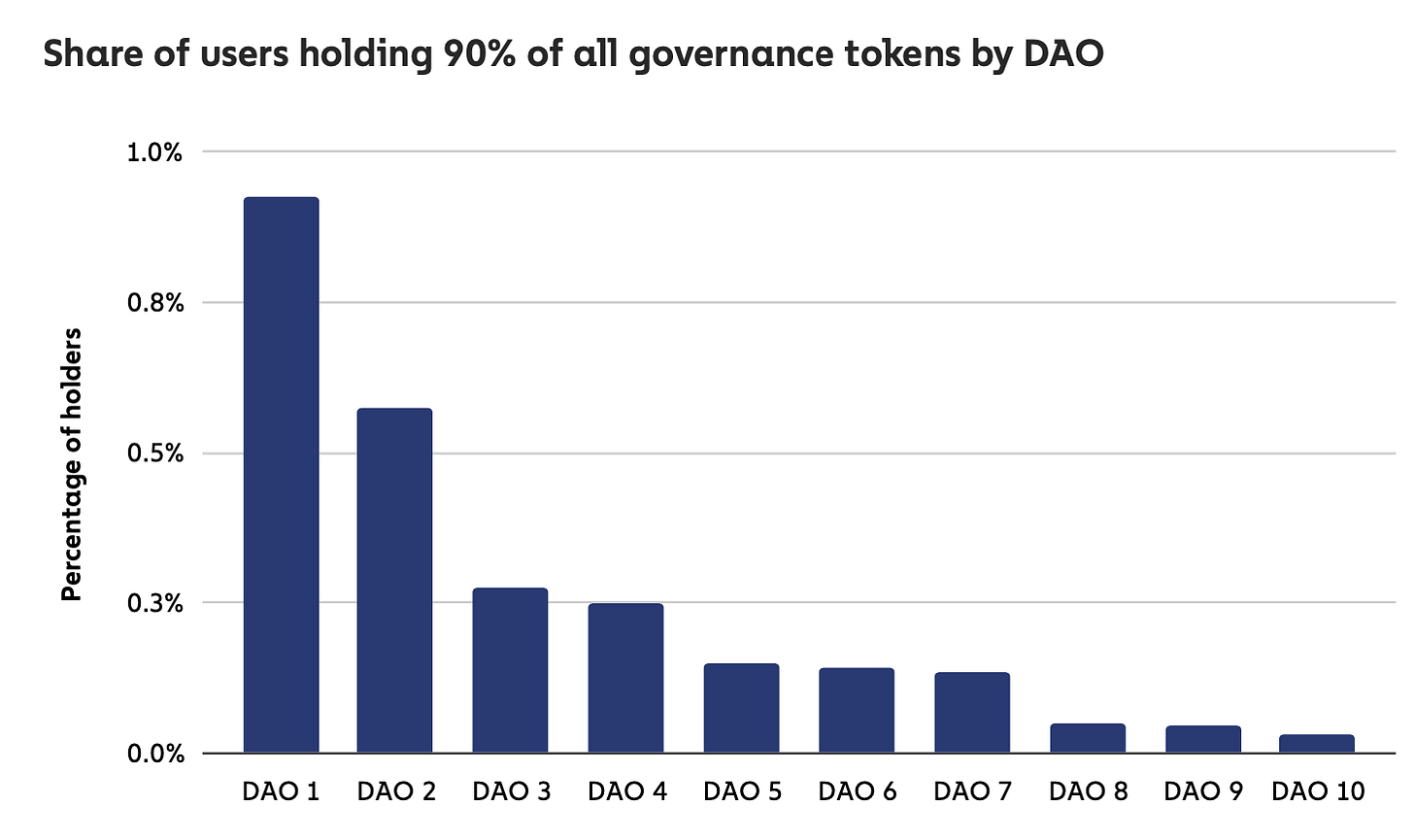

Most DAOs are still decentralized in name only (DINOs). Less than 1% of all holders of DAO governance tokens have 90% of voting power across major DAOs.

Overly concentrated voting power in DAOs can result in decision-making that seemingly contradicts the tenets of decentralization on which web3 is built.

NFTs are global & still going strong

Central and Southern Asia leads the way, followed by North America and Western Europe. While some regions certainly lag, no region has made up more than 40% of all traffic since the beginning of 2021 suggests that NFTs have captured a global audience.

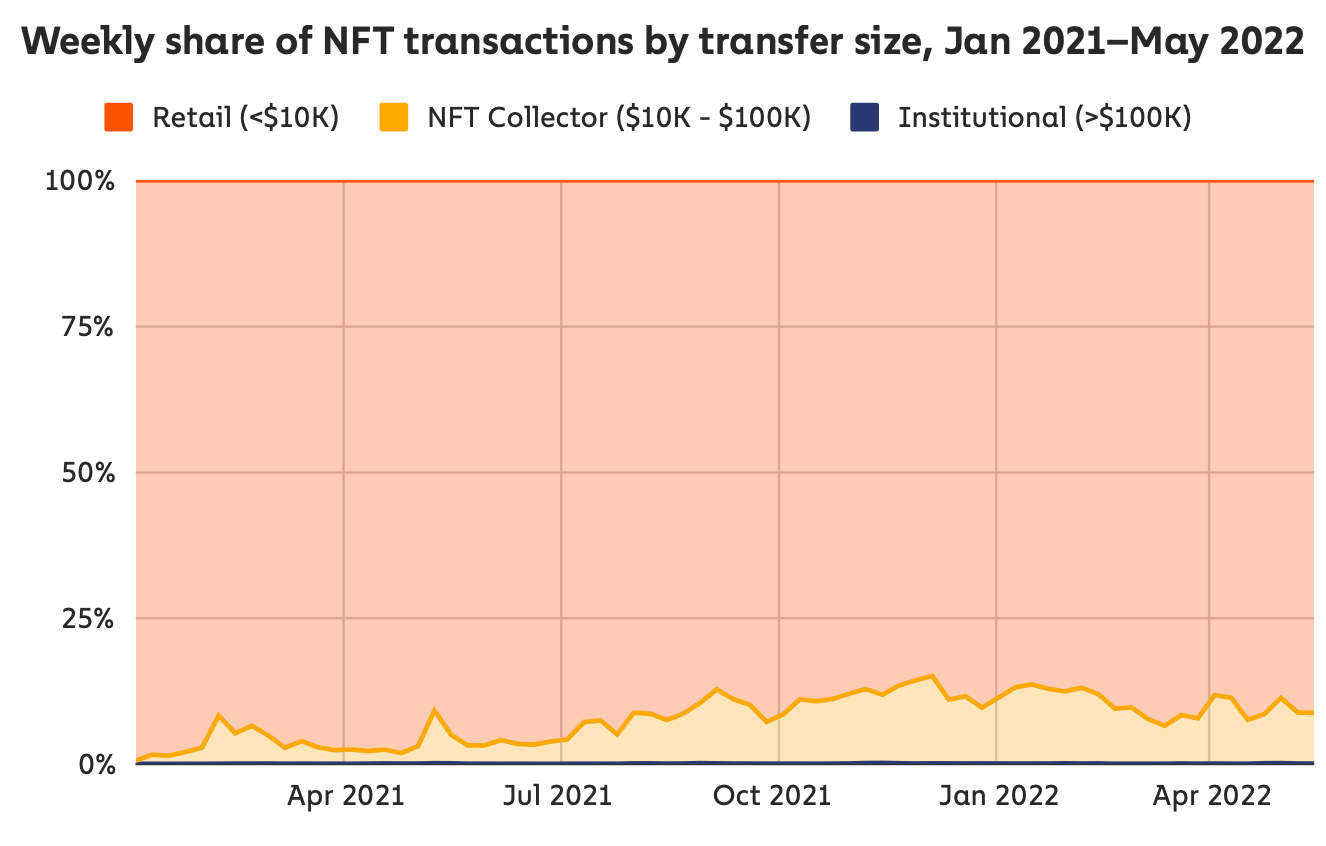

The majority of NFT transactions are at the retail size, meaning below $10,000. NFT collector-sized transactions (between $10K and $100K) grew significantly as a share of all transfers between January and September of 2021, but since then have stayed flat. This suggests that, for the time being, the addition of new retail NFT investors is keeping pace with the addition of bigger NFT investors.

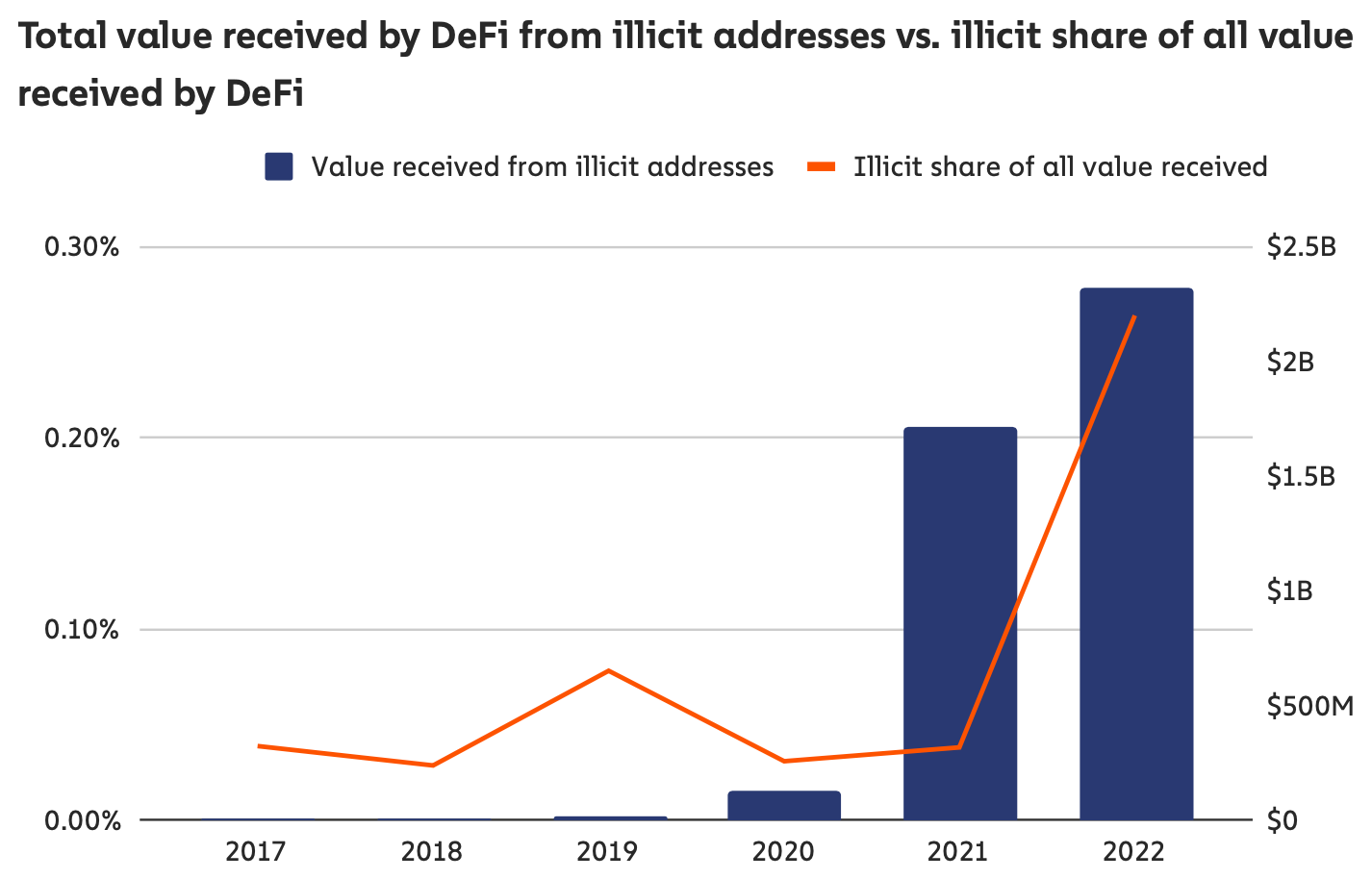

DeFi becomes ReFi

While illicit activity has become a less prominent part of the overall cryptocurrency ecosystem over the last three years, DeFi specifically appears to be experiencing an increase in illicit activity rising over the last two years.

It doesn’t take rocket science to connect the dots and conclude that there’ll be more regulatory involvement in DeFi in the coming years. Thus the evolution from decentralized finance (DeFi) to regulated finance (ReFi).

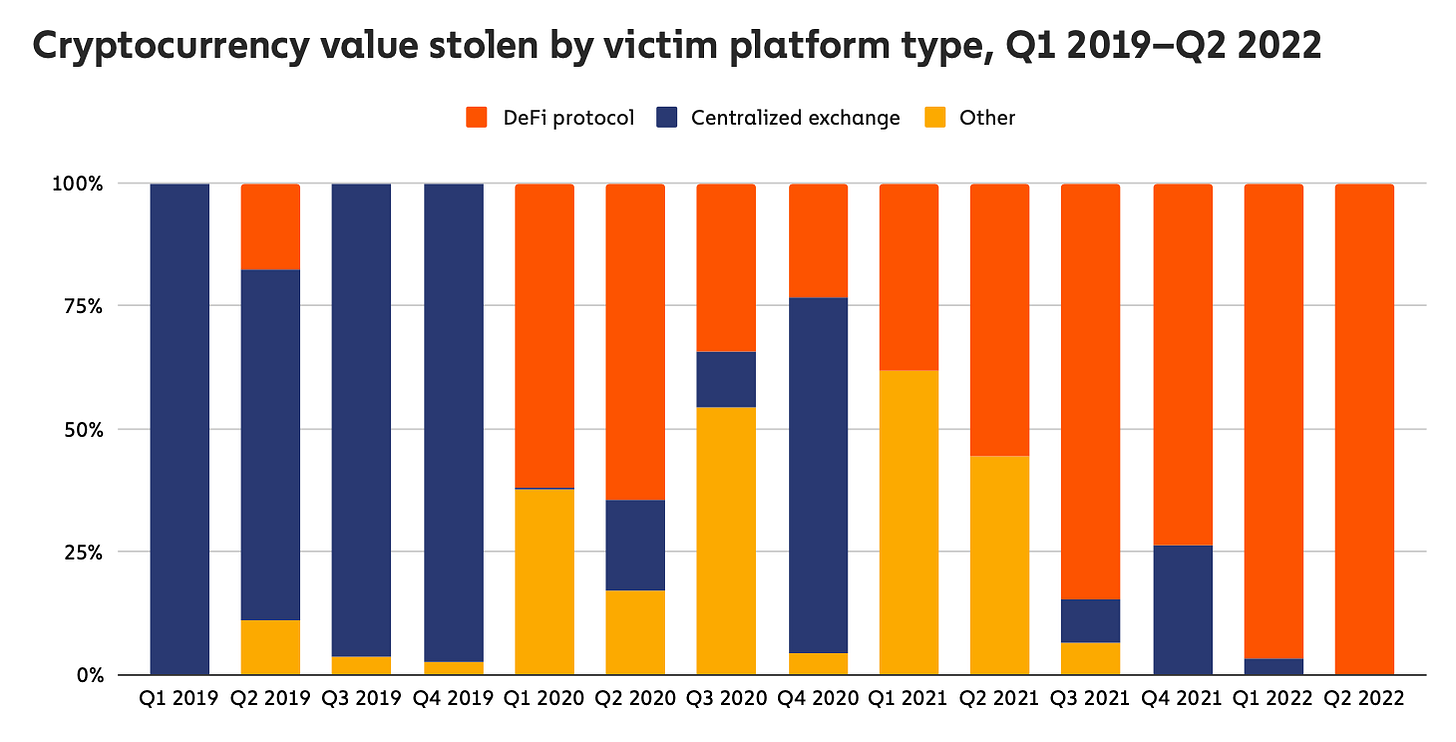

DeFi protocols have been the hackers targets in recent years too. As of May 1, DeFi protocols account for 97% of the $1.68 billion worth of cryptocurrency stolen in 2022.

Even worse, much of the cryptocurrency stolen from DeFi protocols has gone to hacking groups associated with the North Korean government, especially in 2022.